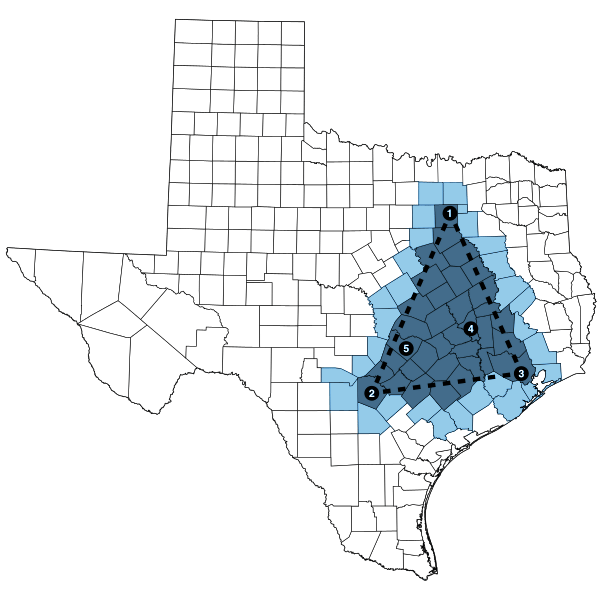

Investing in Land in the Growth Corridors of the Texas Triangle

Texas is rapidly becoming a gravitational focal point in the nation's economic, demographic, and cultural landscape. At Emerging Coast, we invest exclusively in rural land across the Texas Triangle's most active growth corridors, guided by institutional-grade data and analytics.

What We Do

We acquire, hold, improve, reposition, and sell rural acreage in the Texas Triangle: the region anchored by Austin, Dallas-Fort Worth, Houston, and San Antonio. The fastest growing megaregion in the country, the Texas Triangle has absorbed the majority of Texas's historic growth over the past 15 years.

Our strategy is two-pronged: identifying underpriced tracts in high-growth corridors that are positioned for quick development and turnaround, and acquiring strategically positioned land with long-duration appreciation potential. Across both strategies, we operate with a disciplined focus on capital efficiency, execution speed, and downside risk control.

Why Land, Why Now

Structural Migration

Over 9 million people have moved to Texas in the past 15 years. Texas is forecast to surpass California as the most populous state by 2040.

Exurban Renaissance

The rise of remote work, infrastructure investment, and demographic dispersion has driven renewed interest in exurban living.

Mispriced Assets

Land values in key corridors are appreciating rapidly, but many parcels remain mispriced relative to fundamentals.

Overlooked Opportunity

Institutional capital remains focused on multifamily and commercial. Tracts of acreage in exurban areas remain overlooked and inefficiently priced.

Our Approach

Sourcing

Proprietary data tools screen thousands of parcels weekly, identifying undervalued land based on GIS risk filters, comp analysis, access, and subdivision potential.

Acquisition

We target tracts between 15 and 150 acres: too large for most individuals, too small for institutional buyers.

Problem-Solving

We resolve title, mineral, and easement issues before closing, enabling margin to be captured on day one.

Subdivision

Where applicable, we pursue "micro-development": small, regulatory-efficient divisions that unlock retail value without infrastructure spend or protracted capital tie-up.

Data Advantage

We have a significant advantage in identifying, acquiring, and underwriting high-potential properties because of a bespoke, proprietary data engine that delivers institutional-level market intelligence and deal sourcing at scale.

The algorithm scans thousands of MLS listings across the Texas Triangle and cross-references parcels against GIS risk layers and local demand signals. It runs weighted comps to isolate undervalued land while filtering out problematic parcels.

Even before a site visit, this allows us to pinpoint land with the greatest upside potential while prioritizing parcels in areas with proven retail absorption.

Who We Are

Emerging Coast was founded by two brothers, Mark and Andy Cochran, who bring a combined 35 years of real estate investment, analytics, and strategy experience.

Mark Cochran

Mark brings nearly 20 years of experience across acquisitions, underwriting, valuation, development, research, and execution—seven of those years at institutional-scale firms including Barvin, a private equity real estate firm. He studied business at Northwestern and holds an MBA from Rice.

Andy Cochran

Andy has 15 years of private real estate investment experience in Texas. He is also a produced film and TV writer whose storytelling and communications background inform Emerging Coast's strategic planning and investor communications. He graduated summa cum laude from Tulane.

Together, they've managed land, real estate, and energy assets across multiple market cycles, with realized land investment returns averaging over 40% per annum.

Expert Advisors & Contractors

We execute with the support of a seasoned bench of specialists with deep Texas land and subdivision expertise. We work with experienced platting and subdivision consultants to assess feasibility, manage timelines, and navigate municipal and county approvals. We use a surveying firm with more than 20 years of operating history in Texas, and our civil engineer has over 15 years of experience in Texas land development.

We also work closely with a real estate attorney focused exclusively on Texas real estate law, a dedicated mineral rights attorney, and one of the highest-volume land brokers in the state. On the financial side, we maintain disciplined oversight through an experienced bookkeeper and tax accountant.

In addition, we regularly consult a network of trusted colleagues with deep experience in institutional finance and real estate who serve as informal advisors as we evaluate underwriting assumptions, strategy, and risk.

Our Focus: The Emerging Coast

We believe Texas is the next great American growth story. As individuals and institutions rebalance toward affordability, resilience, and lifestyle quality, Texas is emerging as a third major economic and cultural center of gravity in the U.S., alongside the legacy East and West Coasts. The land beneath this shift is already repricing. Our focus is to be there early, with discipline.